Will Pet Insurance Work in the Philippines, and What Will It Do to Veterinary Practice?

By Dr. Geoff Carullo, DVM, FPCCP, DPCVSCA.

Pet insurance can work in the Philippines, and it is already here in several forms. The bigger question is not “Will it exist?” but “How will it actually pay, and will it make veterinary care easier or harder for clinics?”

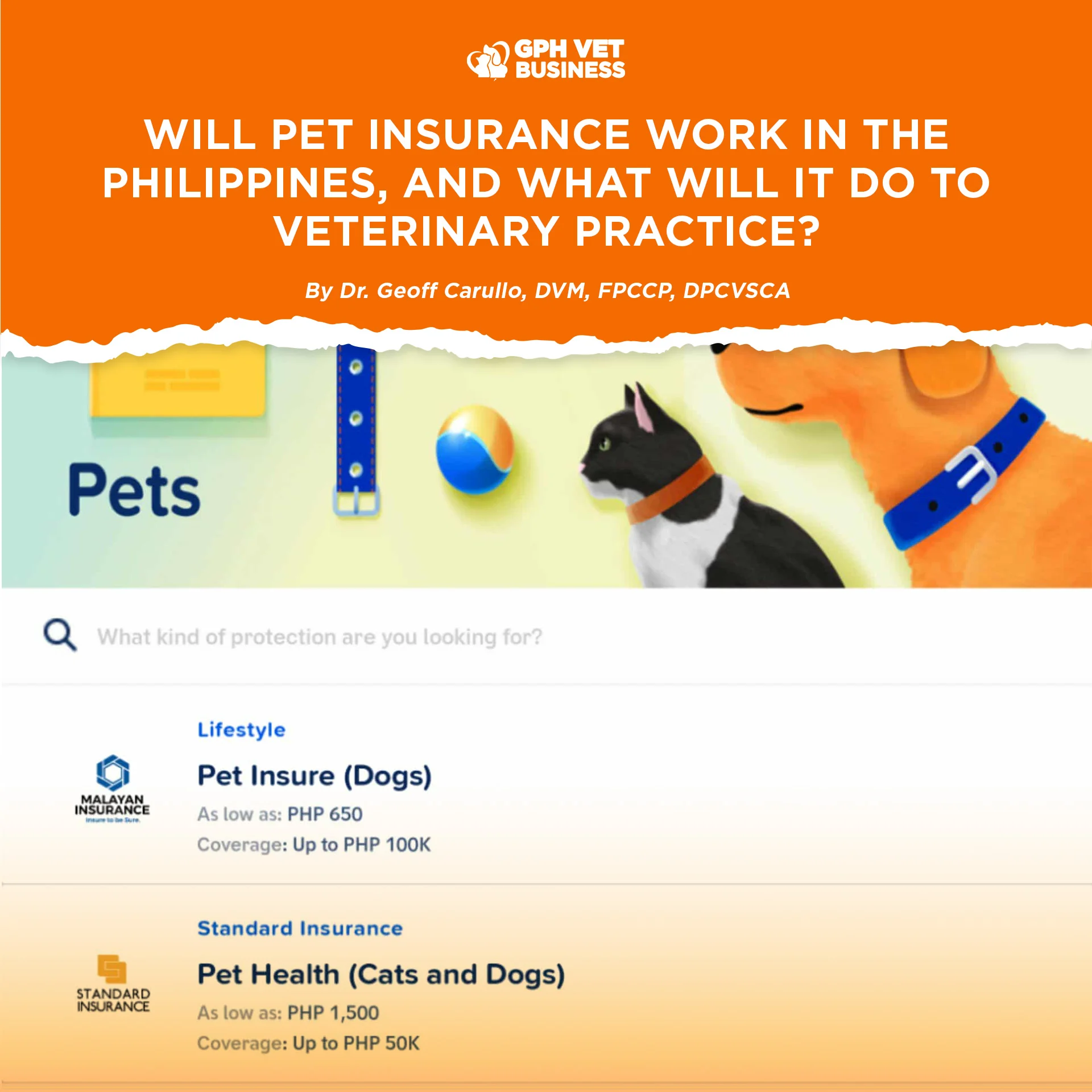

Is pet insurance real in the Philippines?

Yes. There are currently multiple pet insurance offerings available to Filipino pet owners, sold through insurers and marketplaces. Examples include:

- Malayan “Pet Care Insurance” plans for dogs and cats.

- GCash GInsure pet insurance products, including plan details that show medical reimbursement and other benefits.

- Cebuana Lhuillier Pet Insurance, with published benefits, premiums, age limits, and coverage structure.

- The Philippine Insurance Commission has publicly discussed approved pet insurance products and common features like medical reimbursement, burial assistance, owner’s liability, and personal accident cover for the owner.

So yes, it is viable as a product category. The market adoption is the variable.

How pet insurance usually “pays” in the Philippines

Most local offerings are designed primarily as reimbursement-based insurance, not the cashless HMO-style model that many people imagine.

What that means in real clinic life:

- The client typically pays the vet clinic first.

- Then the client files a claim and gets reimbursed by the insurer, subject to policy limits, inclusions, exclusions, documentation rules, and eligibility.

- Some products also bundle non-medical benefits such as owner’s liability and personal accident coverage, which are not clinic revenue streams but can affect client decision-making and risk conversations.

Epekto nito sa vets, good news and real headaches

More clients will say “Yes” to diagnostics and proper treatment

When owners feel protected from financial shock, many become more willing to proceed with:

- CBC, chem, imaging, and confirmatory tests

- hospitalization when needed

- surgery and procedures when clearly indicated

This is one of the healthiest possible shifts for Philippine veterinary medicine, because it moves decision-making closer to medical logic instead of pure budget panic.

You will see a rise in “policy-driven medicine” conversations

Owners will ask:

- “Doc, covered ba ito?”

- “Bakit hindi covered ang preventive?”

- “Pwede ba i-code as accident?”

Many plans clearly state that preventive care is often excluded, while covered illness and accidents may be reimbursable.

So clinics will need a consistent way to explain that coverage rules are insurer rules, not medical rules.

More paperwork, more time spent on documentation

Even when reimbursement is client-driven, clinics often get asked for:

- itemized invoices

- medical records and diagnosis summaries

- lab results, imaging reports

- timeline of signs and treatment

This increases admin load, especially for busy practices.

Potential friction when claims are denied

Denials happen in every insurance system because of:

- pre-existing condition exclusions

- waiting periods

- incomplete documents

- non-covered conditions or benefit caps

When a claim is denied, some owners redirect frustration to the clinic. This will require calm boundaries and clear disclaimers.

“Mababayaran ba kami?” The truth for clinics

In the most common Philippine setup today, yes, you get paid, because you are paid by the client at the time of service, then the client seeks reimbursement. That is the safest model for clinics.

The higher-risk scenario is “direct billing,” where the clinic waits for the insurer. Unless you have a formal agreement with clear timelines, requirements, and dispute handling, that model can create receivable delays.

So the practical clinic answer is:

- If it is reimbursement, you are generally safe, because payment is still point-of-care.

- If it becomes direct pay, you must treat it like a corporate account, with strict SOPs and terms.

What smart clinics will do early

- Keep your records clean and consistent: diagnosis, differentials, treatment plan, and discharge notes.

- Make invoices itemized: consult, diagnostics, meds, confinement, procedures.

- Use a standard “insurance assistance” policy: what you provide, what you do not promise, and how long it takes to prepare documents.

- Train your front desk with a simple script: “We can provide the medical documents, but approval and reimbursement depend on your insurer and your policy.”

Bottom line

Pet insurance can work in the Philippines, and it is already operating through multiple providers and channels.

For veterinarians, it can increase case acceptance and reduce financially delayed care, but it will also increase documentation demands and “coverage argument” conversations.

And yes, in the usual reimbursement model, clinics still get paid the normal way, by the owner first.

Dr. Geoff Carullo is a Fellow and the current President of the Philippine College of Canine Practitioners.

Sharing this helps others understand what it really means to be a vet. Like and follow if you’re with us.